How to invest in the stock market using eToro

I’ve always had an interest in the financial markets but, like most of us, I had no real idea how to break through the castle walls and actually trade. The gatekeepers of Wall St. and The City have forever been committed to keeping the masses at bay so they can charge their hefty trading fees (The Wolf of Wall Street – true story).

I’ve always had an interest in the financial markets but, like most of us, I had no real idea how to break through the castle walls and actually trade. The gatekeepers of Wall St. and The City have forever been committed to keeping the masses at bay so they can charge their hefty trading fees (The Wolf of Wall Street – true story).That all changed about a year ago. I was a final year student looking to earn a few extra quid, and came across a platform called eToro which blew open the doors and allowed me to start trading online.

Since then I’ve risen through the ranks of eToro and today have hundreds of people who follow and copy my trades because of my healthy and consistent gains.

My performance over the past year

Since I started on eToro I’ve more than quadrupled my initial investment (337%) as well as earning an additional $3,600 by becoming a ’Popular investor’ (more on that later).

Sound easy enough?

Well, actually it’s not all that straight-forward. It’s important for you to know that I have been on quite a learning curve. Whilst I’ve been making good money (and enjoying the whole experience), I’ve also made some rookie mistakes.

For total beginners the eToro platform and the concept of trading itself can be a little daunting at first. So with the benefit of hindsight and my own personal trading experience on eToro, I wanted to put together a comprehensive no-nonsense guide to help others get the best results as quickly as possible. And here it is…

eToro would describe themselves as an accessible trading platform that incorporates a social element into investing. I’d describe them as Facebook for trading. They first went live in 2006, and are now the world’s largest investment network with a community of 4.5 million users and over 400 million trades so far.

eToro would describe themselves as an accessible trading platform that incorporates a social element into investing. I’d describe them as Facebook for trading. They first went live in 2006, and are now the world’s largest investment network with a community of 4.5 million users and over 400 million trades so far.

The platform and the wider phenomenon of social investing have been widely covered by mainstream media, including a recent BBC documentary called Traders: Millions by the Minute.

The most unique feature of eToro is probably ‘CopyTrader‘. This allows you to sort through other users and plainly see their trading history, including how much they have made or lost over any given period. If you find someone you like the look of, you can allocate some funds to automatically copy their trades.

Another big plus is the ‘Popular investors‘ program. This rewards users based on how many copiers they have in the form of monthly commission (up to $10,000 a month!). The program also incentivises safe and responsible trading, and we’ll discuss this in more depth towards the end of the guide.

So with the social and copying features, really very little financial knowledge is needed to get started, but you’ll certainly learn a great deal relatively quickly! Most of the need-to-knows you’ll pick up by reading this guide or playing with a demo account.

Take it easy at the start and make sure you know what you’re doing before investing larger amounts of money. Trading on eToro can be very profitable (and this guide will help you achieve this) but it’s important to note that, whenever you’re dealing with the markets, you can lose money too (“your capital is at risk”)!

Take it easy at the start and make sure you know what you’re doing before investing larger amounts of money. Trading on eToro can be very profitable (and this guide will help you achieve this) but it’s important to note that, whenever you’re dealing with the markets, you can lose money too (“your capital is at risk”)!

Getting started

-

Sign up for eToro.com

No lengthy paperwork here, it’s free and really very straightforward! You can either join using your Facebook account or simply enter a username, email address and password.

You’ve now opened up the world of real-time trading You’ll be taken to ‘My Watchlist’ which will show trending markets for now.

You’ll be taken to ‘My Watchlist’ which will show trending markets for now.

-

Deposit

You don’t need to make any deposits now if you don’t want to, you might want to get familiar with it all first. However since this is a guide about investing within eToro, you will of course need to make an initial deposit to do this.

Click on ‘Deposit Funds’ at the bottom left. The minimum you can deposit is $200, which is perfect for getting started as you need $100 to copy someone and you don’t want to put all your eggs in one basket.

Note: eToro’s main currency is $USD but you can deposit in £GBP and other major currencies. It will be converted to $USD in your account.

-

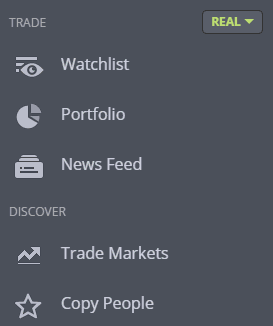

Familiarising yourself with the platform

I’ll just give you a very quick overview of the main sections of eToro for now. We’ll delve more into each one later as I explain how to browse and trade in detail.

Watchlist

Watchlist

Organise the people and markets you’re interested in copying or investing in. You can create multiple lists, such as ‘promising stocks’ or ‘people to copy’.

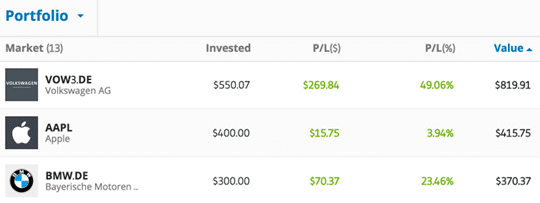

Portfolio

The nerve centre of your investment journey. View all your open trades with live tickers and values, and monitor your performance.

News Feed

This is just like your News Feed on Facebook, where you can see everything the traders you follow have been doing and saying recently.

Trade Markets

The place to research and trade in the markets available to you: stocks (eg. Apple), currencies (eg. GBP/USD), commodities (eg. gold) and indices (eg. UK100) and ETFs.

Copy People

The heart of the community. Search through other traders who you may want to copy or follow. There are loads of useful filters to help narrow down to the results you want, such as markets and performance. -

Bonus: Free tips & special promotions

Join my personal mailing list for the latest tips, strategies and exclusive promotional codes. I don’t email often, but when I do it’s worth knowing about, so don’t miss out!

Now that you’re a part of the community and have explored the site a little, I’m going to share the 3 main ways to invest on eToro with you.

Copying other good traders (CopyTrader)

This is the simplest way to invest on eToro and so the most recommended path for beginners. When you copy someone, every trade they execute is simultaneously opened in your account too and then closed when they close it.

It’s all proportional to what % of your total account’s funds you choose to allocate to them (more on this later), but ultimately you will achieve the same rate of return as they do.

Finding reliable traders to copy on eToro isn’t always as straightforward as it might appear. You need to know what to look for and what to stay clear of (more on this later on). Allow me to help you master the art of copy trading…

Avoid the most common mistakes!

Let me point out the numero uno mistake beginners make right away: being a sheep. When you venture into the ‘People’ section looking for a trader to copy it’s intuitive to sort by ‘most copied’ and blindly copy the top results. You’d think that the most copied people have lots of copiers for a reason, right? The wisdom of the crowd perhaps.

Let me point out the numero uno mistake beginners make right away: being a sheep. When you venture into the ‘People’ section looking for a trader to copy it’s intuitive to sort by ‘most copied’ and blindly copy the top results. You’d think that the most copied people have lots of copiers for a reason, right? The wisdom of the crowd perhaps.

But the reality is that most people on eToro are complete beginners and don’t really know what they are doing. If a few people copy a trader for the wrong reasons, that trader can quickly ‘go viral’ with exponentially more copiers following suit without thinking for themselves. Let me give you an example.

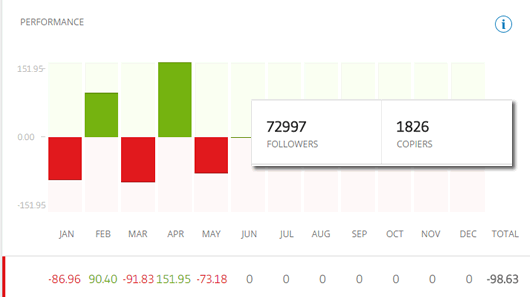

A popular yet under-performing eToro trader

Even though this trader has extremely poor performance (he would have lost 98% of your money over the last five months if you’d copied him), he still has close to 2,000 people copying him! Bizarrely this happens quite a lot on eToro, so I’ll be explaining the process I follow when copy trading.

Having warned against consistently under-performing traders, the other big pitfall beginners fall into is over-trading. It’s incredibly tempting to keep checking how much you’ve made or lost every few hours, but emotions will cloud your better judgement and lead to tinkering.

No trader will EVER profit every single week or month, so I highly recommend you take a medium/long-term approach. This requires patience and discipline, but you’re more likely to see better gains over time.

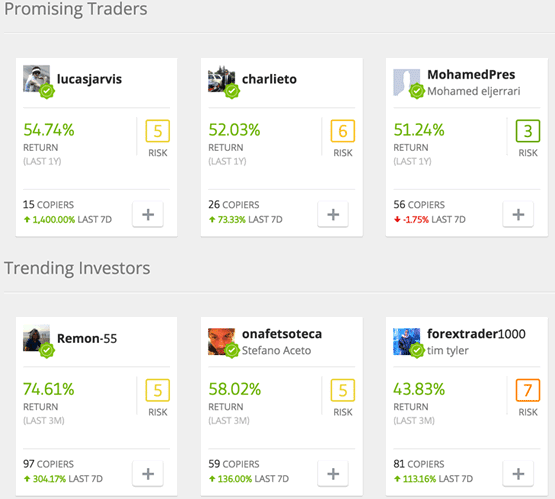

Finding the best traders to copy

First off click on ‘Copy People’ on the eToro sidebar.

You can either simply scroll down the page to see promising and trending popular investors…

…or you can use the advanced search feature. Everything in blue you can change to meet the criteria you’re seeking in potential traders to copy.

Hit ‘GO!’ for a list of matching traders, ordered by number of copiers they have. To further drill down use the filters at the top.

6 attributes EVERY trader you copy should have:

- Been on eToro for at least six months and haven’t just made amazing gains because of one or two lucky punts

- Really demonstrate their market knowledge and experience on their profile feed

- Have low weekly and daily drawdowns (basically how much they’ve been ‘down’ over a given period). Anything more than 10% should be a red flag

- Don’t have ridiculous returns. I know this may seem counter-intuitive, but if you see someone with 1,000%+ returns in a very short period of time, realise that this is unsustainable luck and can only be achieved by being reckless

- Don’t have a 100% win rate. It’s perfectly normal to close some trades in the red, this is a sign of discipline and experience. Beginners chase their losses, proper traders know when to cut loose

- Are communicative. You want to copy someone who can help you learn and is willing to share their trading methodology. If they don’t reply to your messages they either don’t care (likely to trade carelessly too) or they don’t know how to answer because they don’t have a clue what they’re doing!

If you haven’t already, subscribe to my mailing list where I’ll let you know about the latest traders worth copying, plus lots of other juicy info

Viewing a trader’s past performance

I’ll now walk you through assessing an individual trader before outlining the exact steps to copy a trader, so you can understand what to look for and how the process works.

Viewing a trader’s stats

By clicking on the ‘stats’ tab in a trader’s profile you can access some very useful information to help determine whether they are worth copying or not.

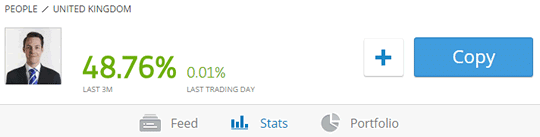

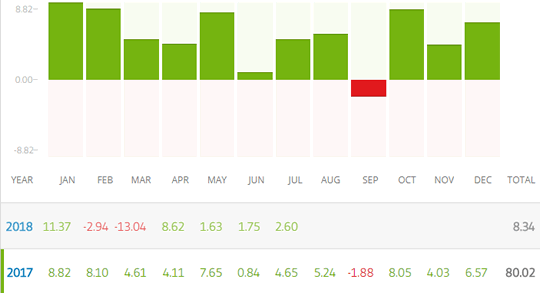

Below you can see my own returns since I started on eToro. If you had copied me with $100 six months ago, you would now have about $487. How does that compare to your savings account’s interest rate? It goes without saying that such returns do come with risk too – I did have a month during which I lost 20%.

My eToro performance

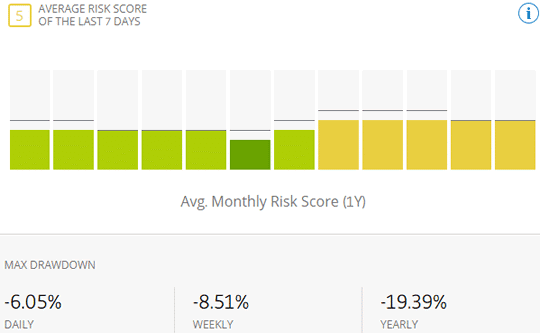

There are two other key things to look at here. The risk score indicates how risky a trader is and the weekly drawdown shows the maximum a trader has ‘been down’ in a single week during this period. Same idea for daily and yearly.

Trader’s risk/reward stats

It’s interesting to compare current risk to past months to see how their strategy has evolved. Anything green shows a very safe, low-risk low-return attitude. The spectrum then moves through yellow, orange, red and black where the risk is highest.

I personally steer clear of anyone with more than a seven, but it can be good to have a mix of traders with different styles.

How to copy a trader

Copying itself is simple. Once you’ve found a trader who you feel is reliable, simply open their profile and click on the blue ‘Copy’ button.

You’ll then be prompted to enter an amount with which to copy that trader, and you’ll see some useful information appears.

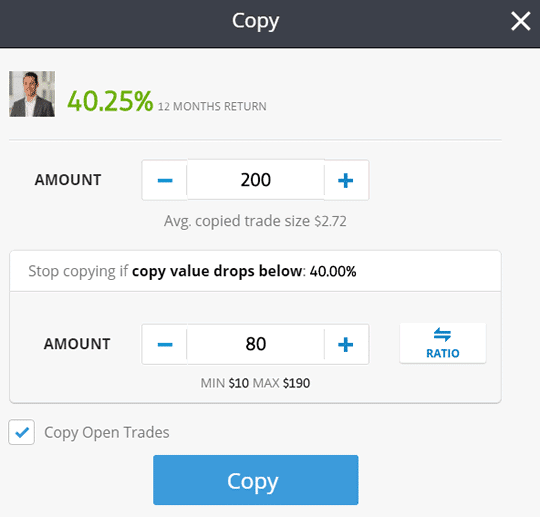

Copying a trader

Let’s say you copy a trader with $100, then “Avg. copied trade size” leads us to how the copying actually works in real dollar terms. In the example above, each trade you copy would be (on average) $2.28. Proportionally this is just 2.28% of the total ($2.28 out of the $100) of your total investment in them. In this case, it’s a good sign as it shows a cautious and safe investment style.

You can also set a “stop loss”, which is a means of protecting against heavy loses, set at 40% by default. If the person you are copying loses 40% of your investment, your account automatically stops copying them. You can set this level to whatever you want, depending on how much risk you’re prepared to take. Personally I keep the number closer to 25%.

Monitoring your performance

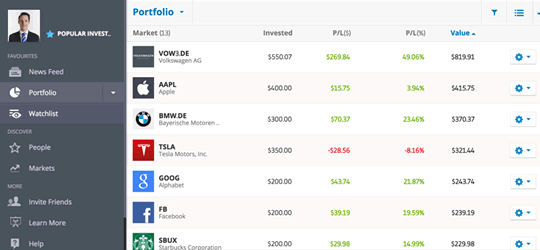

Clicking on ‘Portfolio’ takes you to your open trades.

My Portfolio showing Open Trades

This is the actual trading area and your nerve-centre. Here you can monitor all of your current open positions and close them, and also access a record of your trading history.

All of your copied traders (and in fact any of your own investments) will be listed in your Portfolio. You can see your overall return on the investment in a trader, and also click on the person to see what positions they (and you) currently have open, and how these are performing individually. Usefully you’re able to close individual copied trades without uncopying a trader altogether.

Watchlist users

It’s worth noting that you can also just ‘follow’ traders (without copying or investing in them) so their updates show up in your Watchlist and News Feed, as with Twitter. It’s a good way to gauge whether you think they’re worth copying and tune into useful information.

I recommend following @AnnieToro as she’s the eToro English community manager and is extremely knowledgeable and helpful.

Trading well yourself

Once you’ve familiarised yourself with the eToro platform and (hopefully) had some success copying other people, you can start thinking about placing your own trades.

Once you’ve familiarised yourself with the eToro platform and (hopefully) had some success copying other people, you can start thinking about placing your own trades.

The good news is that you don’t have to be a financial genius with decades of experience to make money trading yourself.

The bad news is that you do need to think a bit harder and do your research. Any shortcomings are squarely on you now!

Focusing your energies on the stock market also gets you used to the platform and the whole process of opening and closing positions without too much pressure. You probably have a fair amount of existing consumer knowledge here too.

Which stocks should you choose?

Well, that’s up to you partner. I cannot offer specific investment advice. All I will say is that it pays dividends to do your homework, read the news frequently and listen to earning announcements. Only invest in stocks or companies that you believe are in a strong and healthy position to resist market shocks, and ultimately have room to grow.

If you’re really serious, you might also want to read up on the price/earnings ratio to identify undervalued/overpriced stock.

Check more here